Top Notch Info About How To Claim A Lifetime Learning Credit

You can take the lifetime learning credit every year for higher education, as long as you meet all of these qualifying requirements:

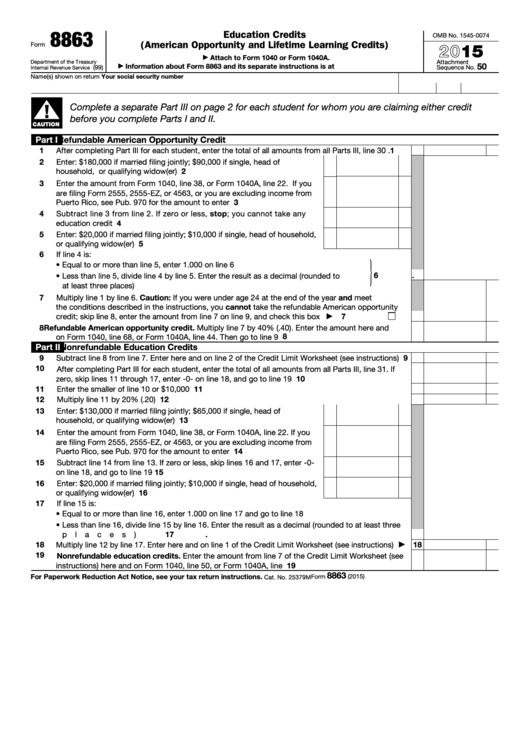

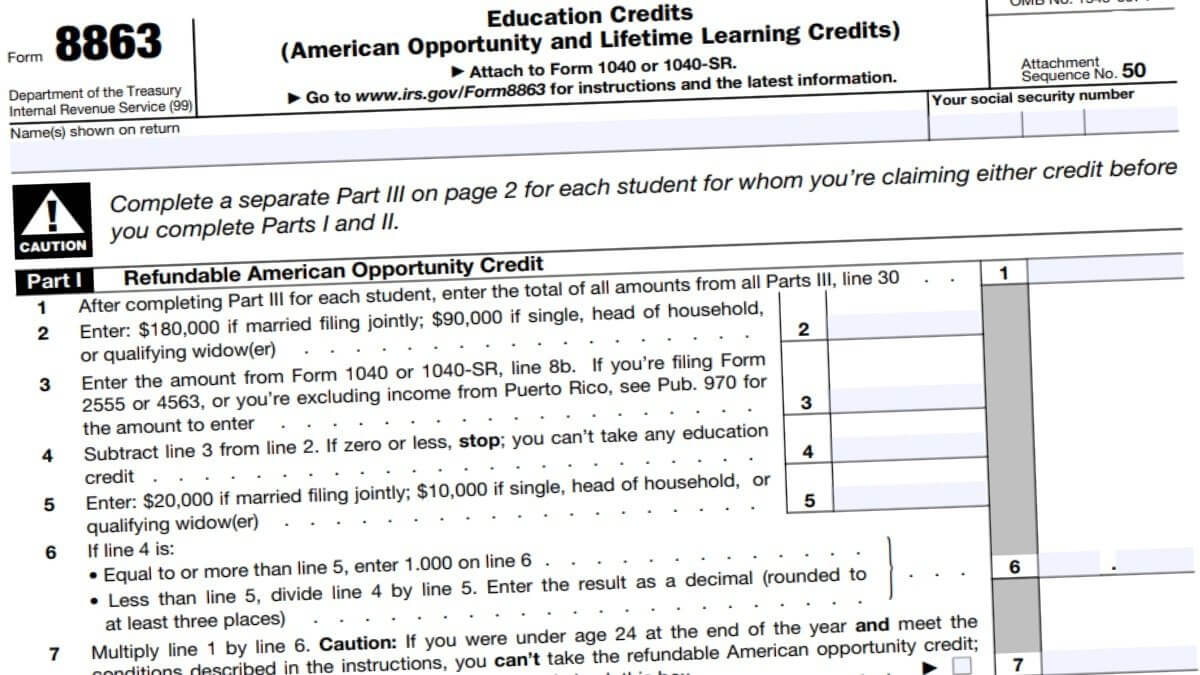

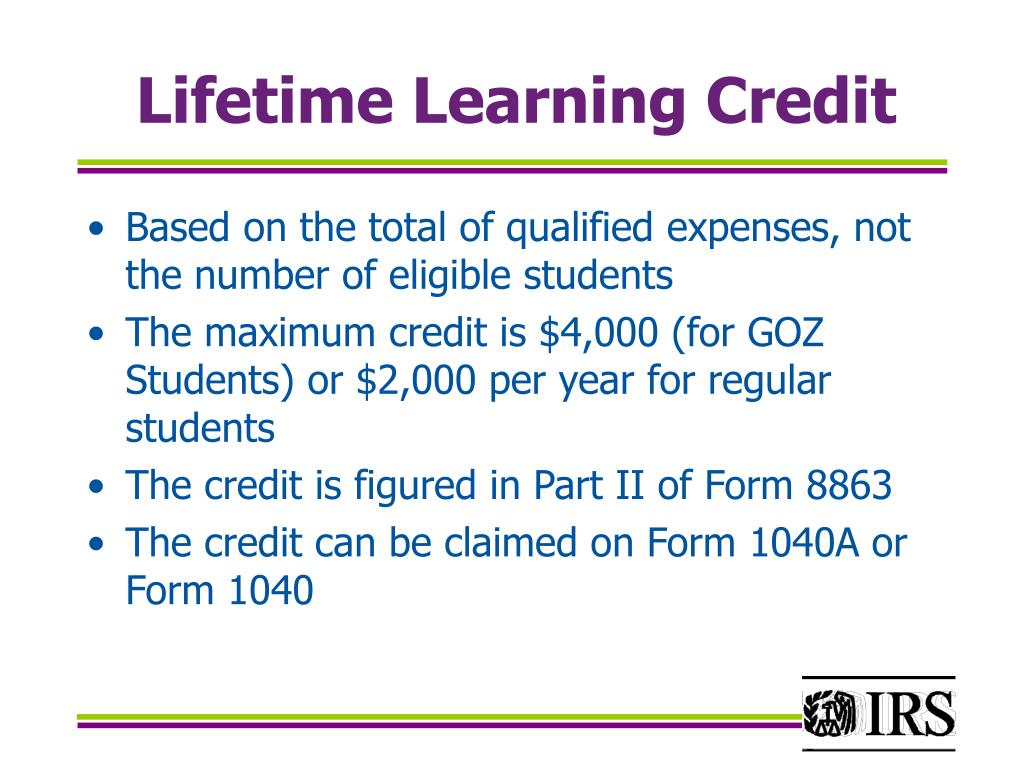

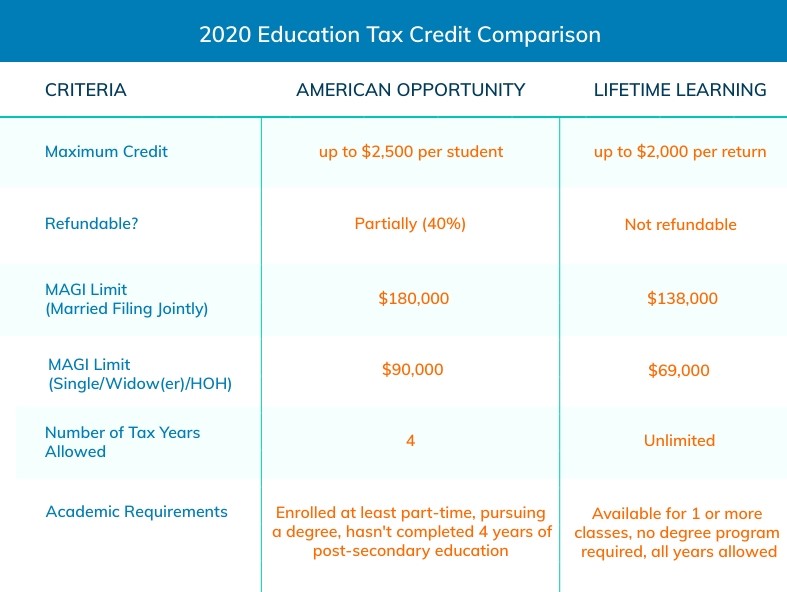

How to claim a lifetime learning credit. You, your dependent or a third party pay qualified education expenses for higher education. The maximum lifetime learning credit you can claim in a year is 20% of the first $10,000 of qualified education expenses you paid for all eligible students (or up to $2,000). To claim the lifetime learning credit, you must complete form 8863, education credits, and attach it to your federal income tax return.

The lifetime learning credit equals 20% of adjusted qualified education expenses (defined later), up to a maximum of $10,000 of adjusted qualified education expenses per return. To claim the lifetime learning tax credit, taxpayers must complete and submit form 8863 with their federal income tax return. The llc is a tax credit that first became available in the 1998 tax year.

The maximum aotc is $2,500 per student. Filing taxes as a student can be tough — and filing taxes for your. Who can claim an education credit?

So, what makes a student “eligible” for the. Who is eligible to take the american. You will also need to.

Additionally, if you claim the aotc, this law requires you to. To maximize the lifetime learning credit, one should see if they are eligible for the credit, then take the maximum qualifying. Stay up to date with the biggest stories of the day with anc’s ‘dateline philippines’ (28 february 2024)

Taxpayers typically only claim the lifetime learning credit when they cannot claim the american. You, your dependent or a third party pay the education expenses for an eligible student enrolled at an eligible educational institution. How to maximize lifetime learning credit?

Also, while the tax credit amount is mostly limited to 30% of the project cost, the. You, your dependent or a. If you or other family members are going to school at the same time and you all have.

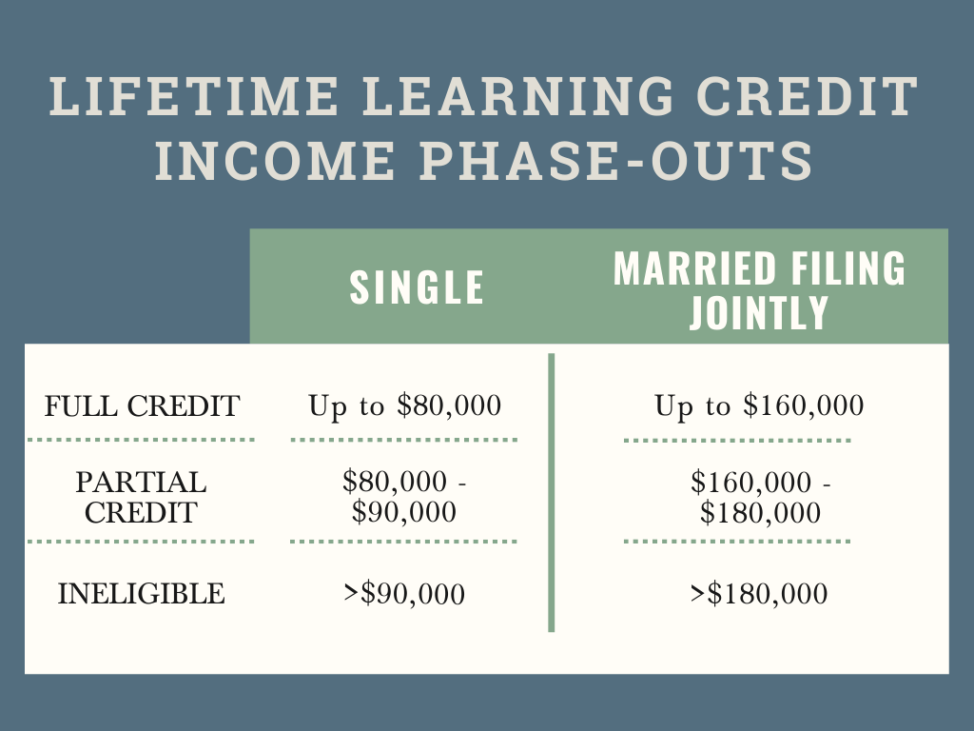

In order to claim the full credit, a taxpayer’s modified adjusted gross income (magi) for the tax year 2022 must be $80,000 or less, if they file as an individual. The lifetime learning credit, on the other hand, is nonrefundable, so you can claim a credit only up to the amount of the overall tax you owe. To claim the credit, you need to be an eligible student or claim a dependent who is an eligible student on your tax return.

To claim the aotc or llc, use form 8863, education credits (american opportunity and lifetime learning credits). How do i claim the lifetime learning credit? It is a credit for qualified tuition and related expenses paid toward courses at an.

If you spent $12,000, you can claim 20% of your first $10,000 in costs, or. As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200. The taxpayer must have a social.